Foundation News

SBA Loan Keeps Boise Family’s Barber Shop Business Afloat

Posted by Ben Shuey on July 16, 2020

Getting a great haircut can feel life-changing, but for Liz and Anthony Madrid, giving other people haircuts is what actually changed their lives.

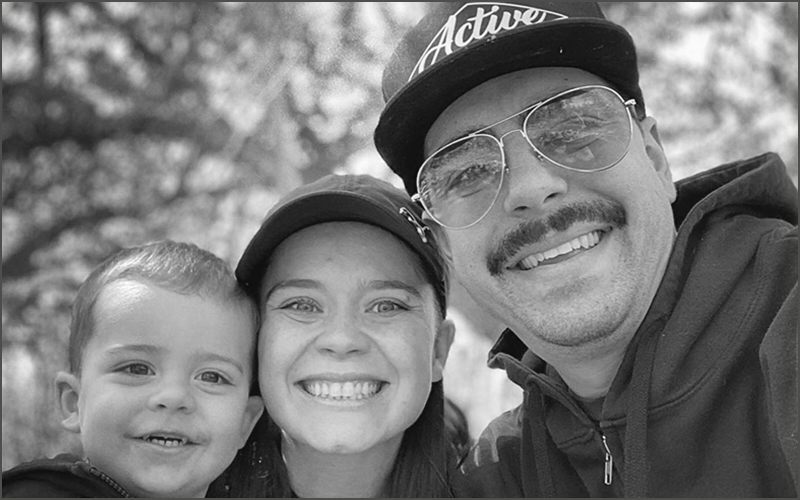

In 2017, the husband-and-wife duo left their corporate careers to start Madrid Barber — a one-chair, luxury barbershop in downtown Boise. Though both are certified professional barbers, Anthony handles most of the grooming services while Liz tackles operations, customer service, and advertising — all while being the busy parents of their two-year-old son. It’s a partnership that allows them to focus on forming personal relationships with their clients and community.

“We always wanted to work together in some form where we can give back to the community, work with our hands, know our clients, and be involved in their lives,” said Liz. “We consider each of our over 600 clients our family — we call them the Madrid Barber Family. Before COVID, we had quarterly happy hours at the Owyhee Tavern, movie nights, and other community events.”

When the pandemic hit in March, Liz and Anthony had to make the tough decision to temporarily close up shop, feeling a responsibility to prioritize the health and safety of their beloved clients.

“In our business, we’re literally in our clients faces, so it was a little scary. We closed a week before the shutdown and stayed closed from March 18 until May 16,” explained Liz.

The Madrids personally called clients to cancel over 200 future appointments — and their revenue started to take a big hit. When the Small Business Administration’s Paycheck Protection Program Loan launched at the beginning of April, Liz got in touch with CapEd Credit Union, where she’d been a member for nearly eight years and a business client for two.

“I was so grateful for my partnership with CapEd. When I read about the PPP, I immediately reached out and was directed to Casey Taylor, who was amazing. As soon as I applied, the first round of funding ran out, but Casey stayed in constant contact with me. When the second round opened, he helped me re-apply.”

Once her loan application was approved, Liz said Taylor, CapEd’s Vice President of Commercial Lending, was able to make the funds available the very next morning. It was a lifeline for the Madrid family.

“The PPP really helped my husband be able to take a paycheck during the month of May, and where it is really helping is in June, because we’ve had to completely change the way we do business.”

After two months, the Madrids finally reopened the barbershop, and their loyal clientele was overjoyed.

“Eight weeks is a really long time in the barber world,” said Liz, laughing. “A lot of clients were looking awfully shaggy by the time we reopened.”

But even as the state of Idaho began reopening in stages, the Madrids knew things wouldn’t be going back to normal anytime soon. The couple spends hours deep-cleaning the shop every day — first thing in the morning, before and after every appointment, and every evening before close. But they’re not complaining.

“The PPP has really allowed us to focus on those things and not our revenue stream. That money has allowed us to take care of our family while we get back on our feet.”

Through June 2020, CapEd Credit Union funded over 400 PPP loans for its members.

“It was a collaborative effort on the part of the Commercial Team and other departments within CapEd,” said Taylor. “Learning about stories such as Madrid Barber made the long days/nights entirely worth it. We look forward to servicing our members with the pending forgiveness portion of the PPP loans.”

Have a question or comment about this story? Email us!

Posted in Community Impact.