Foundation News

Mountain America and ICCU Educate Idahoans During Idaho Financial Literacy Day

Posted by Ben Shuey on March 19, 2021

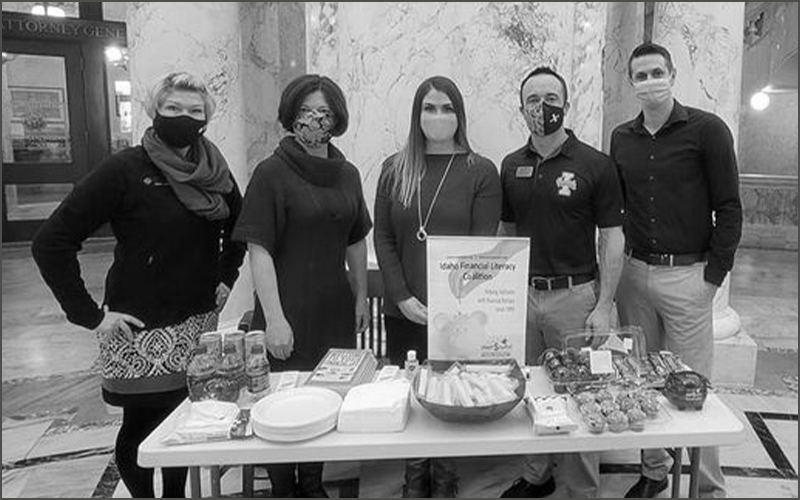

Every year, the Idaho Financial Literacy Coalition gathers at the Boise Capitol for a day in February to share the coalition’s financial literacy efforts and resources with local lawmakers.

This year, Mountain America Credit Union and Idaho Central Credit Union joined several organizations, including IDeal, the Idaho Department of Finance, and the University of Idaho Extension Office, to set up financial education booths and snack tables on the second floor of the Capitol rotunda.

“We at the Idaho Financial Literacy Coalition are proud to support financial education efforts across Idaho,” said Angela Phillips, President of the IFLC Board and Public Relations/Social Media Manager at Mountain America. “We came out to talk to lawmakers and the public about the importance of financial literacy for our youth, and to share what our organizations are doing to support financial education in our state.”

Phillips explained that while this year’s event had a smaller turnout due to the pandemic, the overall reception was positive.

Kristy Massie, Business Development Officer at ICCU, shared she had a very meaningful interaction with a couple of security officers who stopped by her booth.

After offering the young men some free swag and snacks, Massie asked them if they had any financial questions she could answer. It turns out, one of them did. He’d heard it was easier to get approved for an auto loan with a credit union versus a bank, and wanted to know if that was true.

“I let him know that the lending process can be, for the most part, very similar among lenders,” said Massie. “I went on explain that one difference between a bank and a credit union is when it comes to loans — the interest rates [at credit unions] can be lower at times. He then said he remembered his friend mentioning that.”

Massie walked him through ICCU’s lending process, shedding light on interest rates, how to apply for a loan, what a good credit score looks like, and which factors impact the loan interest rate the most.

“We continued to have a great conversation about monitoring his credit on a regular basis through our online banking credit monitoring widget, called My Credit,” Massie said. “He logged on to his ICCU e-branch right away on his cellphone and found the My Credit Widget. He was so excited about this!”

Listening in on the conversation, the other security officer then chimed in, admitting he didn’t have any credit history, which prompted a discussion about how to build credit using a secured loan.

“I explained to both of them what a secured loan/credit card is and how it works,” said Massie. “I encouraged both of them to look into doing this as it is a great time of year — with it being tax season — and they could use their tax return to do a secured Visa and continue to build their credit. I also explained the typical timeframe it takes to build credit and what some of the main contributing factors are that impact a score.”

Thanks to Massie, the two men left the conversation armed with a better understanding of the loan process, interest rates, credit, and ICCU’s credit monitoring tool.

This interaction underscores the importance of Idaho Financial Literacy Day and the ongoing need for financial literacy curriculum and/or financial education options for Idaho residents of all ages.

“I encourage all Idaho credit unions to get involved with the Coalition this year,” said Phillips. To learn more about the IFLC, visit it online.

Posted in Community Impact.