Foundation News

Rural Credit Unions Are Evolving with Help from NWCUF

Posted by Ben Shuey on August 18, 2021

The Northwest is constantly changing. Its storied landscapes, diverse communities, and economy never stop evolving.

As the financial needs of Northwest residents shift, credit unions continually strive for new innovations that meet those needs. That is especially true in rural areas where remoteness, evolving economies, and sometimes, banks closing branches or leaving, make it challenging for residents seeking financial services.

“Rural residents need a financial partner they can trust to help grow their communities, expand economic development, and bridge the earnings gap,” said Dr. Neil Tocher, professor and Chair of the Department of Marketing and Management in the Idaho State University College of Business.

Tocher’s department recently partnered with Pocatello, Idaho-based Connections Credit Union to research the state of underbanked residents in the credit union’s field of membership (FOM). Funded by a grant from the Northwest Credit Union Foundation’s Rural Access to Financial Services Initiative, the research will help Connections Credit Union assess and provide innovative ideas to support the financial well-being of rural populations.

Launched this spring, the Rural Access to Financial Services initiative is part of NWCUF’s strategic goal of accelerating the impact credit unions have in the communities they serve in the Northwest. In rural areas, credit unions play a critical role in ensuring communities remain economically viable and members have access to necessary financial products and services to thrive. NWCUF’s planning grants are designed to help credit unions understand the unique needs of local communities and craft specific services to meet them. The Foundation is excited to continue providing grants and resources to support credit unions in identifying community-based solutions across the region.

By participating with the Rural Access to Financial Services initiative, Connections Credit Union President and CEO, Brian Osberg, said the ISU research project will help his credit union provide customized service to rural members that directly addresses the financial challenges they face.

“CCUs mission is ‘Connecting Communities and Members to Modern Financial Services while Empowering Financial Success through Time Honored Credit Union Values,’” Osberg said. “We want to make sure that we are serving this mission in all areas including rural zones that have been left behind by banks recently.”

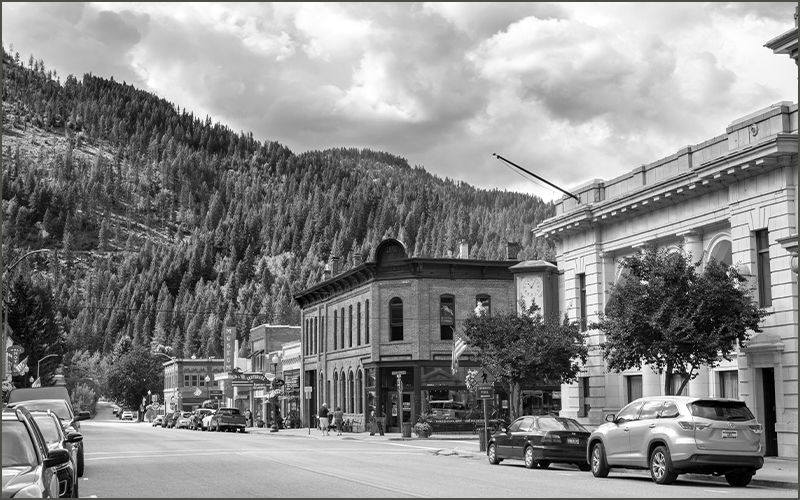

Old West Federal Credit Union, based in John Day, Oregon, plans to open a new branch in Enterprise, Oregon and will be using an NWCUF planning grant to conduct a feasibility and demographic study of the agricultural and ranching community to find the sweet spot for the service it needs most.

“We want to understand how we can serve that community best,” said Bob Kavanaugh, VP of Business Development and Member Experience at Old West. “We know Enterprise very well, but we want to know it better. We know a new location there will work, but we want to go in with the right data and perspective right off the bat.”

Kavanaugh said he hopes the study and deeper discussions with community members will help the credit union understand members’ needs including the kind of fintech desired by members or pinpoint a just-right location for the community. He said that kind of community perspective and drive to provide the unique and specific services needed is how credit unions are different than the banks that are increasingly pulling out of communities like Enterprise.

Central Willamette Credit Union, based in Albany, Oregon, is expanding its FOM. Like Old West, Central Willamette will use its planning grant to do a demographic study of the new rural areas in its FOM to ensure the credit union provides the right products and services for rural residents.

“Our FOM has always incorporated rural areas,” said Erik Fedler, marketing manager at Central Willamette. “Now more than ever a focus on the specific needs of these communities is important and the partnership with NWCUF continues to aid in creating partnerships to assist those that are not only underbanked but also underprivileged due to income, location, or any other contributing factor.”

Stacie Wyss-Schoenborn, Central Willamette President and CEO, said the Rural Access to Financial Services program is the kind of initiative the credit union has come to expect from NWCUF.

“We have been able to create programming through grant programs offered by NWCUF, but more importantly, they are a partner that will assist us in any manner we need connecting us to other CUs or to resources outside the CU world,” said Wyss-Schoenborn. “We are grateful for all their hard work to ensure Northwest CUs can achieve beyond the financial services we provide.”

Posted in Rural Access.