Foundation News

Thousands of High Schoolers Across the Region Learn Real-World Budgeting Skills

Posted by Ben Shuey on January 15, 2020

When young adults venture out on their own, whether they’re headed to college or work, it’s critical that they understand how to budget and save so that they may make smart money choices. The choices they make today will set them up for success in the years to come.

Credit unions believe in building that foundation by providing financial education to children and young adults. It’s part of the credit union philosophy of “People Helping People”.

During the 2018-2019 school year, credit unions across the Northwest did just that – preparing more than 3,500 students for the future by showing them how critical it is to prioritize saving and spending wisely.

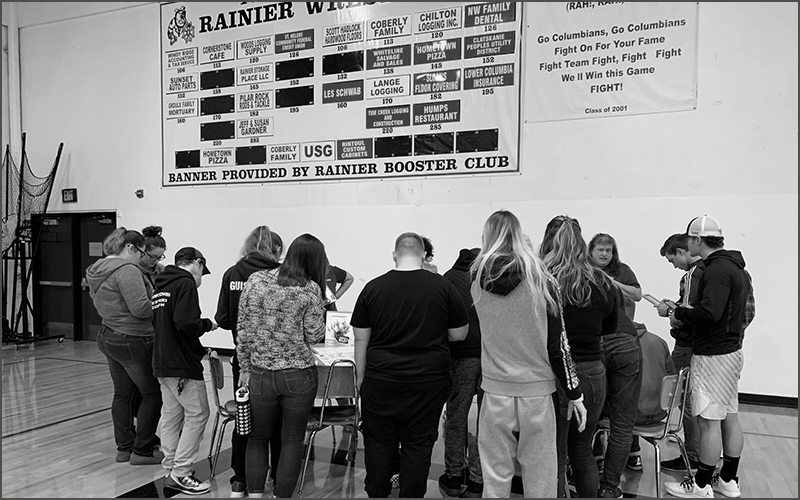

Along with their own robust financial literacy programs, credit unions hosted Financial Reality Fairs in partnership with local schools throughout the school year, giving students the opportunity to hone their budgeting skills with the Bite of Reality app.

Grants from the Northwest Credit Union Foundation made 40 fairs possible during the school year, educating thousands of students throughout the region. The Foundation has partnered with credit unions to offer Financial Reality Fairs for the past seven years, but in 2018, the event transitioned from pen-and-paper to a digital format, which resonated with a tech-savvy generation.

“The feedback we have received on the Bite of Reality app is extremely positive. Students enthusiastically engage with it, getting an in-depth look at just how critical it is to save and budget,” said Sharee Adkins, Executive Director of the Northwest Credit Union Foundation.

During the 2018-2019 school year, an estimated 800 students in Idaho, 1,600 in Oregon, and 1,100 in Washington participated in Financial Reality Fairs. The Bite of Reality app, used on a tablet or smartphone, provides students with a persona, career, and starting salary. Students experience a typical day in the life of an adult, facing financial responsibilities and choices. They are tasked with finishing the exercise with a balanced budget.

The 90-minute Financial Reality Fair includes making important decisions, like budgeting for a car payment and factoring in costs such as insurance, groceries, rent or a mortgage, childcare, and entertainment. As they go through the exercise, credit union employees provide them with financial counseling, helping the students make smart choices.

The program is tailored to teens ages 15 to 18, but it also can be tailored for young adults entering college.

“We look forward to the year ahead, working with credit unions and schools throughout the region to help young adults establish the solid budgeting skills they’ll need to succeed in life,” Adkins said. “Credit unions provide budgeting and saving expertise to people of all ages – there is no better partner to turn to for financial education.”

If your credit union would like to host a Financial Reality Fair, please learn more by visiting the Northwest Credit Union Foundation online.

Posted in Asset Building, Financial Reality Fairs.